CA For Buyers Only Realty Loan Application Initial Disclosures 2014-2026 free printable template

Show details

TruthinLending Mortgage, NLS# 234984 Originator: Eugene Berman, LIC# 01265271, NLS# 278453 EQUAL CREDIT OPPORTUNITY ACT APPLICATION NO: PROPERTY ADDRESS: The Federal Equal Credit Opportunity Act prohibits

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign for buyers only realty form

Edit your CA For Buyers Only Realty Loan Application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA For Buyers Only Realty Loan Application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA For Buyers Only Realty Loan Application online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA For Buyers Only Realty Loan Application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA For Buyers Only Realty Loan Application Initial Disclosures Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA For Buyers Only Realty Loan Application

How to fill out CA For Buyers Only Realty Loan Application Initial

01

Start by gathering all necessary financial documents such as pay stubs, tax returns, and bank statements.

02

Open the CA For Buyers Only Realty Loan Application Initial form.

03

Fill in your personal information including your name, address, and contact details.

04

Provide details about your employment history along with your income.

05

Enter information regarding your assets and liabilities.

06

Specify the type of loan you are applying for and the purpose of the loan.

07

Review your application for accuracy and completeness.

08

Sign and date the application as required.

Who needs CA For Buyers Only Realty Loan Application Initial?

01

Individuals or couples looking to purchase a home or real estate property.

02

First-time homebuyers seeking financing options.

03

Real estate investors looking to secure loans for investment properties.

Fill

form

: Try Risk Free

People Also Ask about

What is a 3rd party authorization form?

Description. The Third Party Authorization form authorizes a person other than the payor or recipient to act on the payor's or recipient's behalf. A Family Responsibility Office (FRO) support payor or support recipient may designate this person to request and receive information from the FRO regarding their case.

How long is a third party authorization form valid?

Third Party Designee authority is limited to the specific tax form and period of the return, and is limited to issues involving processing of that specific return. This authority will expire one year from the due date of the return regardless of any extension dates.

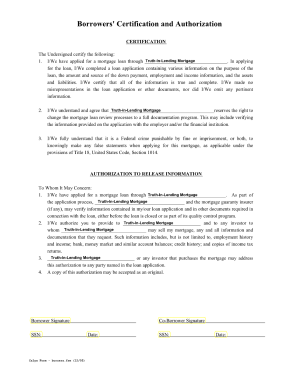

What is borrower's certification & authorization?

This form is sent along with a request to any involved third party providing your authorization to request and receive the information. This speeds along the verification of the information contained in the mortgage application and allows the lender's underwriter to approve your loan request.

How long is a borrower's certification authorization good for?

The authorization to access employment and income history from federal or state records, including SESA records, for this transaction continues in effect for one (1) year unless limited by state law, in which case the authorization continues in effect for the maximum period, not to exceed one (1) year, allowed by law.

How do I write a third party authorization letter?

LETTER OF AUTHORIZATION Please be advised that __(Owner/Applicant name or company name) authorizes (Individual name of/or company name) to act as an agent on my (our) behalf in all matters related to obtaining a __(permit type) permit.

What is a loan authorization letter?

Loan authorization occurs when a lending institution completes its “due diligence” (comprehensive appraisal of the business) and approves the terms it will offer a borrower. As part of the loan authorization, the lender will confirm: The principal amount to be borrowed, loan type and terms of repayment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CA For Buyers Only Realty Loan Application for eSignature?

When you're ready to share your CA For Buyers Only Realty Loan Application, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete CA For Buyers Only Realty Loan Application online?

pdfFiller makes it easy to finish and sign CA For Buyers Only Realty Loan Application online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for the CA For Buyers Only Realty Loan Application in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your CA For Buyers Only Realty Loan Application in seconds.

What is CA For Buyers Only Realty Loan Application Initial?

CA For Buyers Only Realty Loan Application Initial is a document used by buyers to apply for a mortgage loan, specifically tailored for buyers working with Buyers Only Realty.

Who is required to file CA For Buyers Only Realty Loan Application Initial?

Individuals seeking to purchase property through Buyers Only Realty and who require financing to complete the purchase are required to file the CA For Buyers Only Realty Loan Application Initial.

How to fill out CA For Buyers Only Realty Loan Application Initial?

To fill out the CA For Buyers Only Realty Loan Application Initial, applicants must provide personal information, financial details, and property information, ensuring all sections are complete and accurate.

What is the purpose of CA For Buyers Only Realty Loan Application Initial?

The purpose of the CA For Buyers Only Realty Loan Application Initial is to gather necessary information from prospective buyers so that lenders can assess creditworthiness and determine loan eligibility.

What information must be reported on CA For Buyers Only Realty Loan Application Initial?

The information that must be reported includes personal identification details, income and employment information, asset information, liabilities, and details of the property being purchased.

Fill out your CA For Buyers Only Realty Loan Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA For Buyers Only Realty Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.